The Best Payment Gateways for eCommerce Stores – A Comprehensive Comparison

Introduction

Choosing the right payment gateway is crucial for eCommerce success. This guide provides a comprehensive comparison of the top payment gateways in 2025, analyzing their features, pricing, security, and suitability for different business types.

1. What is a Payment Gateway?

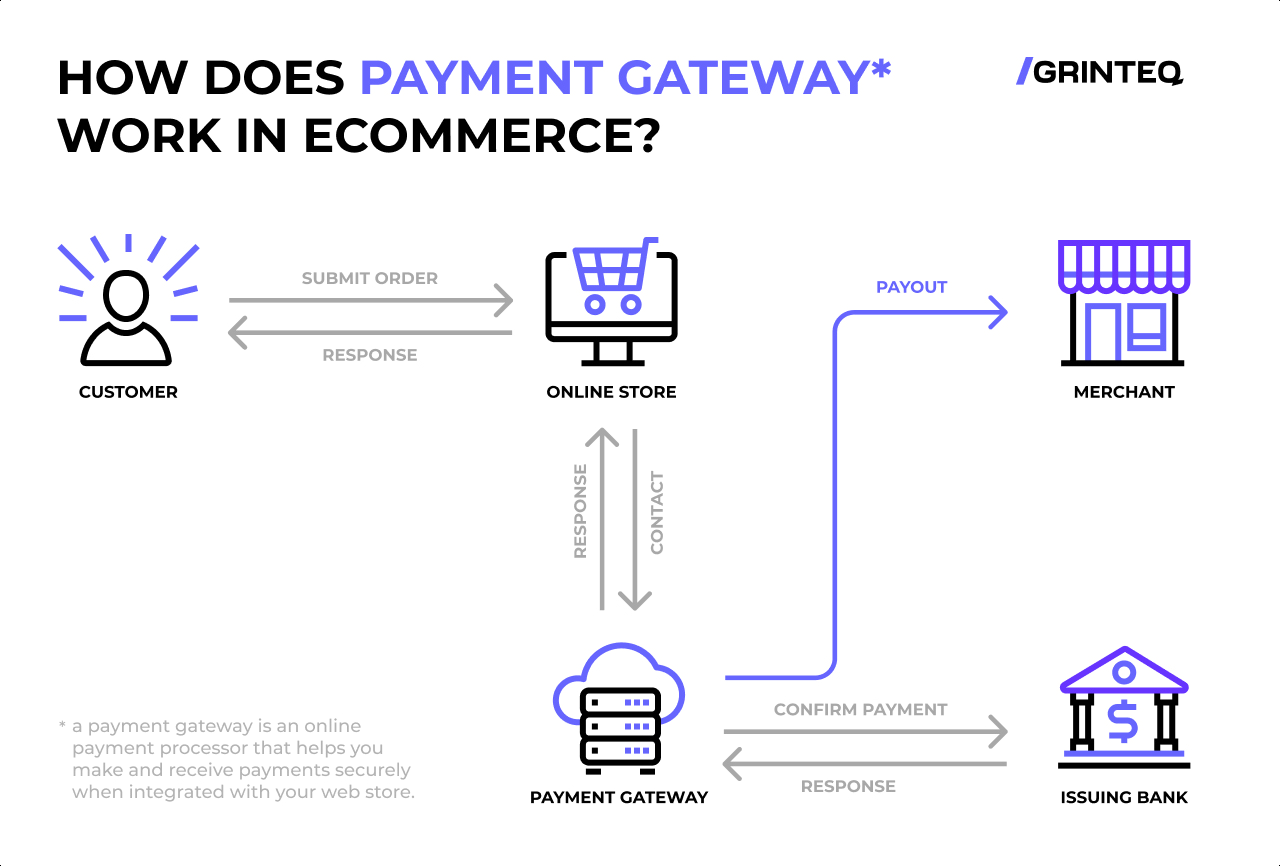

A payment gateway is a technology that facilitates online transactions by securely processing payments between customers and merchants. It acts as a bridge between an eCommerce store, the customer’s bank, and the merchant’s bank.

Key Functions of a Payment Gateway

- Securely encrypts payment data

- Facilitates credit/debit card processing

- Integrates with eCommerce platforms

- Provides fraud protection

- Supports multiple currencies and payment methods

2. Factors to Consider When Choosing a Payment Gateway

Security & Compliance

- PCI-DSS compliance

- Tokenization and encryption

- Fraud detection tools

Transaction Fees

- Setup and monthly fees

- Per-transaction costs

- Currency conversion fees

Integration & Compatibility

- eCommerce platform support

- API flexibility for custom integrations

- Compatibility with digital wallets

Payment Methods

- Credit/debit cards

- Digital wallets (Apple Pay, Google Pay, PayPal)

- Cryptocurrency support

- Buy Now, Pay Later (BNPL) options

User Experience

- One-click checkout

- Mobile payment optimization

- Multi-language and multi-currency support

3. Top Payment Gateways for eCommerce in 2025

Comparison Table

| Payment Gateway | Best For | Transaction Fees | Supported Payment Methods | Key Features |

|---|---|---|---|---|

| Stripe | Developers & Large Businesses | 2.9% + $0.30 per transaction | Cards, wallets, BNPL, crypto | Customizable API, fraud prevention |

| PayPal | Small-Medium Businesses | 3.49% + $0.49 per transaction | Cards, PayPal, Venmo | Easy integration, global reach |

| Square | Brick-and-Mortar & Online Stores | 2.6% + $0.10 per transaction | Cards, wallets | POS system, invoicing support |

| Authorize.Net | Enterprise Businesses | 2.9% + $0.30 per transaction + $25 monthly fee | Cards, wallets, eChecks | Advanced security, subscription billing |

| Adyen | Global eCommerce | Custom pricing | Cards, wallets, BNPL, crypto | AI-driven fraud protection, global payments |

| 2Checkout (now Verifone) | International Sellers | 3.5% + $0.35 per transaction | Cards, wallets | Multi-currency support, subscription billing |

| Braintree (by PayPal) | Subscription Businesses | 2.9% + $0.30 per transaction | Cards, wallets, Venmo, PayPal | Advanced customization, recurring billing |

| Klarna | BNPL Services | Merchant-specific pricing | BNPL, credit/debit cards | Interest-free installment payments |

| Amazon Pay | Amazon Sellers & Large Retailers | 2.9% + $0.30 per transaction | Amazon accounts, cards | Seamless Amazon checkout |

| Worldpay | Large Enterprises | Custom pricing | Cards, wallets, ACH | Global payment solutions, strong security |

4. Detailed Analysis of Each Payment Gateway

Stripe: The Developer’s Choice

Pros:

- Extensive API for customization

- Supports subscriptions and recurring payments

- High-level fraud detection

Cons:

- Requires technical knowledge for full customization

- Customer support can be slow

PayPal: Best for Quick Setup

Pros:

- Global reach and trusted brand

- Easy to integrate with major eCommerce platforms

- Supports multiple payment methods

Cons:

- Higher transaction fees

- Account holds and freezes reported by some users

Square: Best for Small Retailers

Pros:

- Free POS system for in-store sales

- Flat-rate pricing with no hidden fees

- Invoicing and online payment links

Cons:

- Limited international support

- Higher fees for manual card entry

Authorize.Net: Best for Enterprises

Pros:

- Robust security features

- Supports multiple payment methods

- Advanced recurring billing options

Cons:

- Monthly fees make it less cost-effective for small businesses

- Outdated interface compared to competitors

Klarna: Best Buy Now, Pay Later Option

Pros:

- Interest-free installment plans

- Helps increase conversion rates

- Popular among younger consumers

Cons:

- Higher merchant fees compared to traditional gateways

- Limited availability in some regions

5. Choosing the Right Payment Gateway for Your Business

Best Payment Gateway for:

| Business Type | Recommended Gateway |

| Small Businesses | PayPal, Square |

| Large Enterprises | Stripe, Adyen, Authorize.Net |

| Subscription-Based Services | Braintree, Stripe |

| High-Risk Industries | 2Checkout, Worldpay |

| International Businesses | Adyen, 2Checkout |

| Retail & POS Integration | Square, Worldpay |

Questions to Ask Before Choosing

- Does it support my target audience’s preferred payment methods?

- What are the transaction and hidden fees?

- Is it compatible with my eCommerce platform?

- How strong are its security features?

- Can it scale as my business grows?

6. Future Trends in Payment Gateways

AI and Machine Learning in Fraud Prevention

- Real-time threat detection

- AI-powered transaction monitoring

Cryptocurrency and Blockchain Payments

- More businesses accepting Bitcoin and Ethereum

- Decentralized finance (DeFi) integration

Expansion of BNPL Services

- Increased demand for flexible payment options

- Partnerships with major retailers

Biometric Payment Authentication

- Fingerprint and facial recognition for secure transactions

- Improved checkout experiences on mobile devices

Conclusion

Selecting the best payment gateway for your eCommerce store is crucial to ensuring a seamless customer experience and secure transactions. Whether you’re a small business, an enterprise, or a subscription-based service, the right payment gateway can improve your conversion rates and customer satisfaction.